tax on venmo over 600

Starting with the 2022 tax year third-party payment settlement networks eg PayPal and Venmo will send you a Form 1099-K if you are paid over 600 during the year for goods or services. Now even a single sale over 600 the new reporting threshold could land you with a burdensome 1099-K tax form.

Venmo Paypal And Zelle Must Report 600 In Transactions To Irs

The new reporting requirements will ensure anyone who sells a couch or pays a.

. Theres a little bit of confusion over this Venmo rule says Steven Rosenthal senior fellow at the Urban-Brookings Tax Policy Center at the Urban Institute. Once the tax information reported in the 1099 forms is mutually agreed upon by both parties the payer files the returns with the IRS. As of January the Biden Administration requires Americans to report to the IRS all business transactions using third-party payments like Venmo and PayPal for goods or services over 600 thanks to a provision hidden in Democrats partisan 2 trillion stimulus bill from March.

They are however requiring that third-party money sending applications like Venmo and CashApp report total earnings of 600 or more by a single person. Currently online sellers only received these forms if they had at. With the threshold for receiving a 1099k form just 600 most third-party payment network users will find this.

An online payment service like PayPal or Venmo. News Sports Things To Do Lifestyle Opinion USA TODAY Obituaries E. Everything you need to know about claiming tax deductions for your donations.

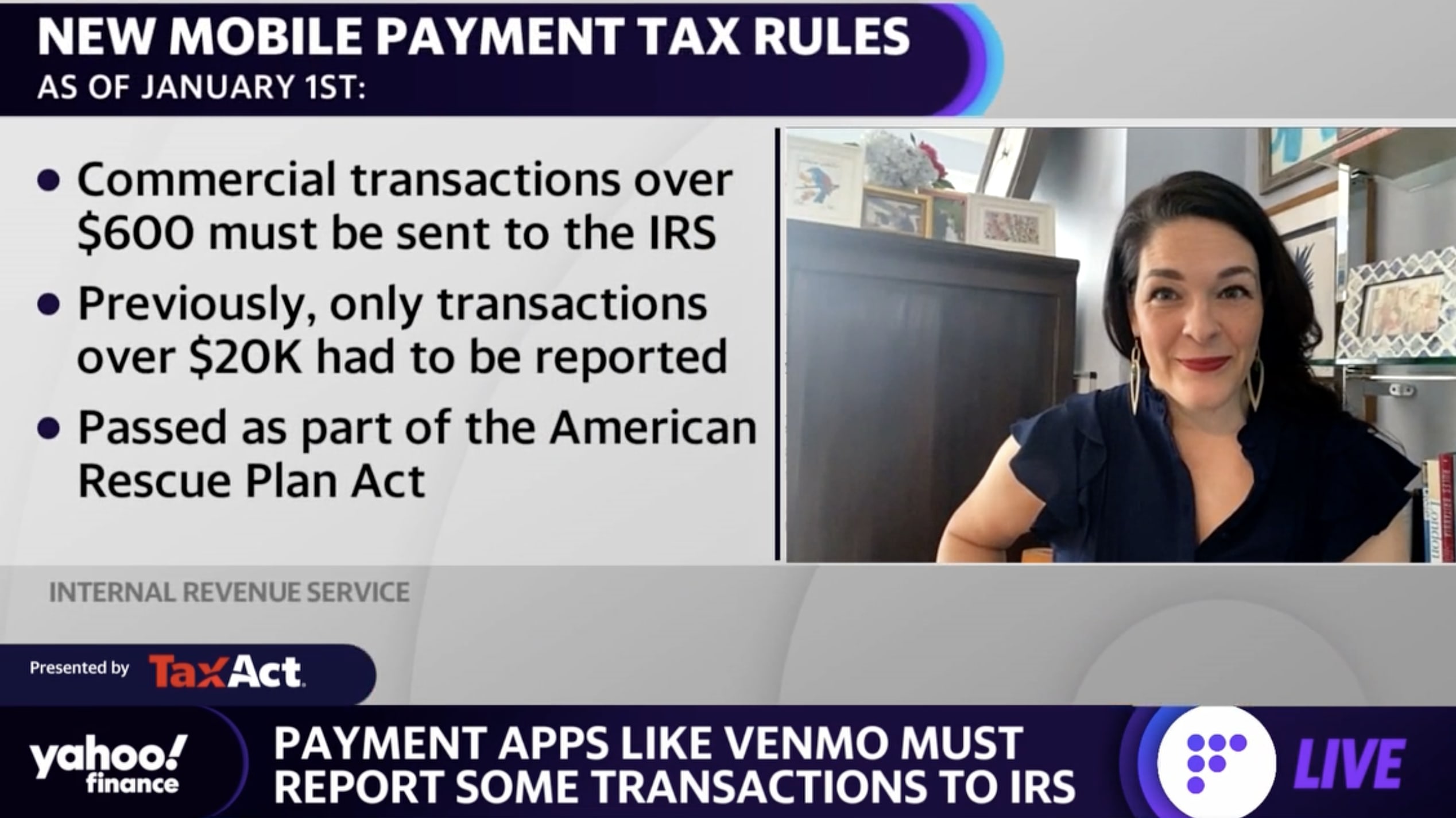

Government passed legislation for 2022 as part of the American Rescue Plan Act that forces online payment platforms like Venmo PayPal Stripe and Square to report all aggregate business. The Tax Notes report also states that the treasury department estimated this form of reporting would raise 463 billion over the 10-year budget window making it the third largest revenue raiser. 1 if a person collects more than 600 in business transactions through cash apps like Venmo then the user must report that income to the IRS.

1 online tax filing solution for self-employed. And I remember the day it started to fade. How are people even selling just unused items or guns or NODs scopes etc in the EE not going to get hit with tax forms for more than 600 in sales.

EBay Main Street. Cash App and Venmo will be issued a tax form called a 1099-K for online sales totaling 600 or more starting next year. This isnt a new tax but rather an easier way for Venmo to track.

Who to donate to what to donate and the special rules for 2022. The American Rescue Plan Act will change how some are taxed for receiving over 600 in third-party funds for online sales on sites like Etsy and eBay. The idea that any payment received over 600 will be automatically taxed as income is false he explains.

As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. Hinson objects to rules that already went into effect in January that require mobile payment apps like Venmo and PayPal to report business transactions of more than 600 to the IRS. A 1099-k form is something that many Americans will receive for the 2022 tax year.

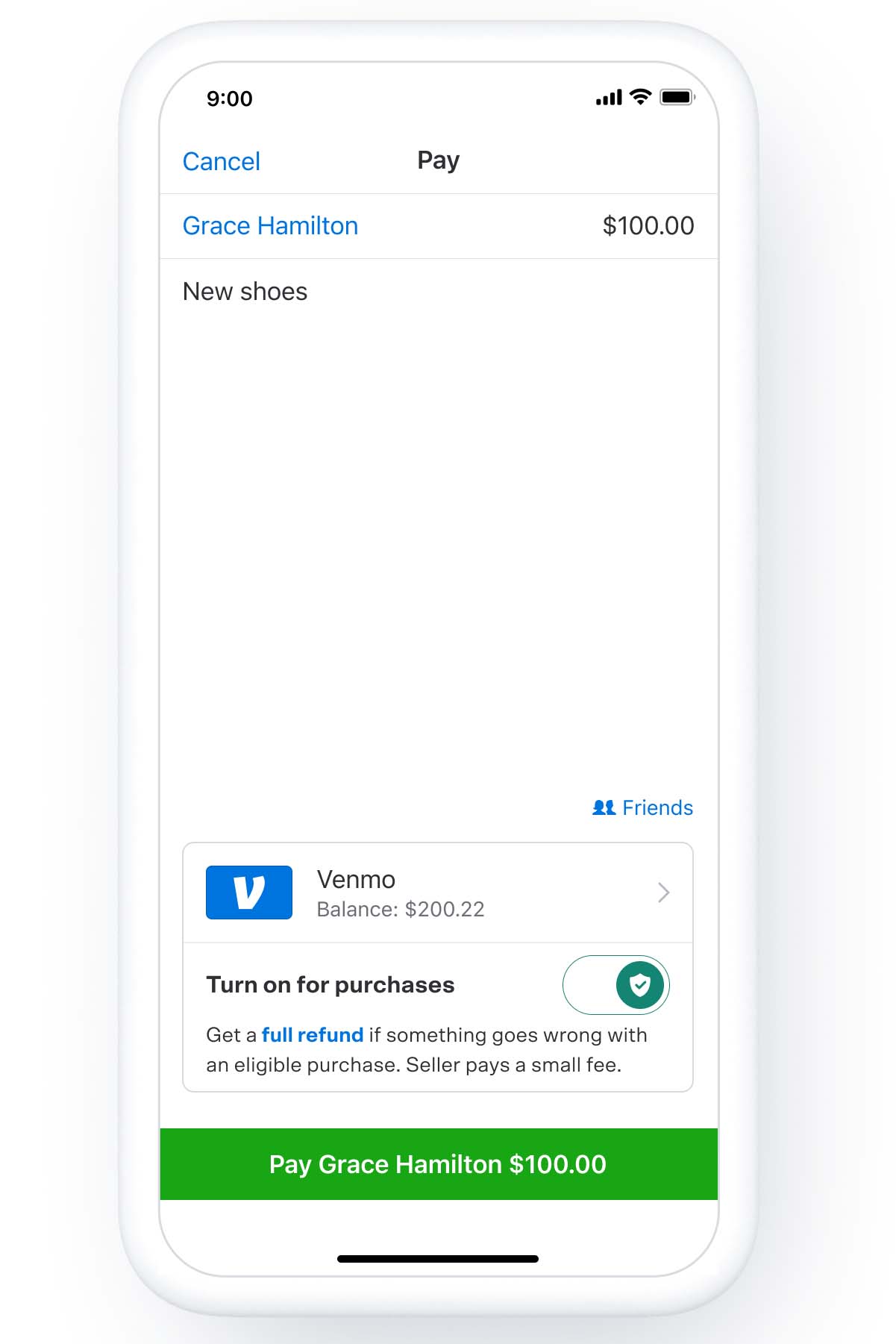

If you plan to use Venmo for business the platform will begin to report transactions totaling over 600 to the IRS each year. If you have paid your payee 600 or more in a tax year and youve reported the same on your 1099 forms then you must send a copy of the 1099 form to the payee. A gift card.

Prior to the law change with ARPA 3 rd party processors like PayPal Stripe and merchant service providers were required to report sales that were over 20000 and there were over 200 transactions. 1 the IRS said if a person accrues more than 600 annually in commercial payments on an app like Venmo then Venmo must file and furnish a Form 1099-K for them reporting. The American Rescue Plan Act will change how some are taxed for receiving over 600 in third-party funds for online sales on sites like Etsy and eBay.

The Venmo tax is relevant to merchants who accept payments via Venmo. 1 2022 third-party payment networks like PayPal and Venmo must now report business transactions totaling more than 600 to the. And the change does not take into account the millions of individuals selling used or pre-owned items where there is no taxable event.

I carried a certain amount of starry-eyed innocence with me early in my tax career. Beginning in 2022 the threshold has been lowered to 600 in payments without any regard to the number of transactions. This tax form might include taxable and.

Problems with the 600 Form 1099-K Reporting. Selling something a few years later you bought at 1000 for 700 will be reported and hit someones tax reporting. Seems like the IRS is going to assume it is income even if selling at a loss.

But even if you dont receive. Soo has over 10 years of experience at publicly traded companies and public accounting firms offering. Venmo and Airbnb to report income over 600 under new IRS rule.

If you cross this threshold the platform will send Form 1099-K to you and the IRS in the following year. In the case of service providers that used processors like these they often received both Form 1099. Starting with the 2022 tax year merchants who receive more than 600 via payment apps will receive a 1099-K form listing the.

Cash App and Venmo will be issued a tax form called a 1099-K for online sales totaling 600 or more starting next year. The IRS is not snooping through your bank account for payments or transactions of 600 or more as of 2021. Over 20000 in gross payment volume AND.

Going forward third-party payment companies will issue you a 1099-K tax form each year if you earn 600 or more annually in income for goods or services. Americas 1 tax preparation provider. Over 200 separate payments in a calendar year.

The New Hampshire attorney generals office says drugmaker Johnson Johnson has agreed to pay 405 million in a settlement with the state over its role in the opioid addiction crisis days. Based upon IRS Sole Proprietor data as of 2020 tax year 2019. Self-Employed defined as a return with a Schedule CC-EZ tax form.

These 1099-K forms are just information reports. Many tax professionalsmyself includedagree that 600 is an. Yes users of cash apps will get a 1099 form if annual commercial payments are over 600 Starting Jan.

Here Are The Tax Changes Coming To Venmo Cash App Paypal And Other Apps Forbes Advisor

New Tax Law Sell More Than 600 A Year Venmo Paypal Stripe And Square Must Report Your Income To The Irs Gobankingrates

New 1099k Threshold Change 600 Taxes Can I Avoid Irs Tax Form For Venmo Paypal Cashapp Zelle Youtube

Afraid The Irs Will Tax Your Venmo Paypal Or Other Payment App Transactions Here S What You Should Do The Washington Post

No Venmo Isn T Going To Tax You If You Receive More Than Us 600 Tech

Press Release How To Confirm Your Tax Information To Accept Goods Services Payments On Venmo In 2022

/arc-goldfish-cmg-thumbnails.s3.amazonaws.com/01-05-2022/t_922560b2db1b4cd3a10b798a2d631ae6_name_Venmo_Paypal_must_report_payments_of_600_61d595b2283c07051d1095e4_1_Jan_05_2022_13_11_02_poster.jpg)

Venmo Paypal Cash App Must Report Payments Of 600 Or More To Irs Kiro 7 News Seattle

Press Release How To Confirm Your Tax Information To Accept Goods Services Payments On Venmo In 2022

The Taxman Cometh The Irs Wants In On Your Venmo

Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You

No Venmo Isn T Going To Tax You If You Receive More Than Us 600 Tech

New Tax Laws 2022 Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You 6abc Philadelphia

New Venmo Tax Law Are You Filing Correctly Behindthechair Com

Venmo Paypal And Zelle Must Report 600 In Transactions To Irs

Advice On Venmo Having To Submit Sums Over 600 To The Irs R Personalfinance

Federal Government To Ask For Taxes On App Transactions Over 600

Taxes What To Know About Irs Changes For Payment Apps Like Venmo Paypal

New Tax Law Venmo Cash App To Report Business Transactions Over 600 Wrvo Public Media

Tax Day Venmo And Paypal Users Face More Paperwork Under New Us Rules Us News The Guardian